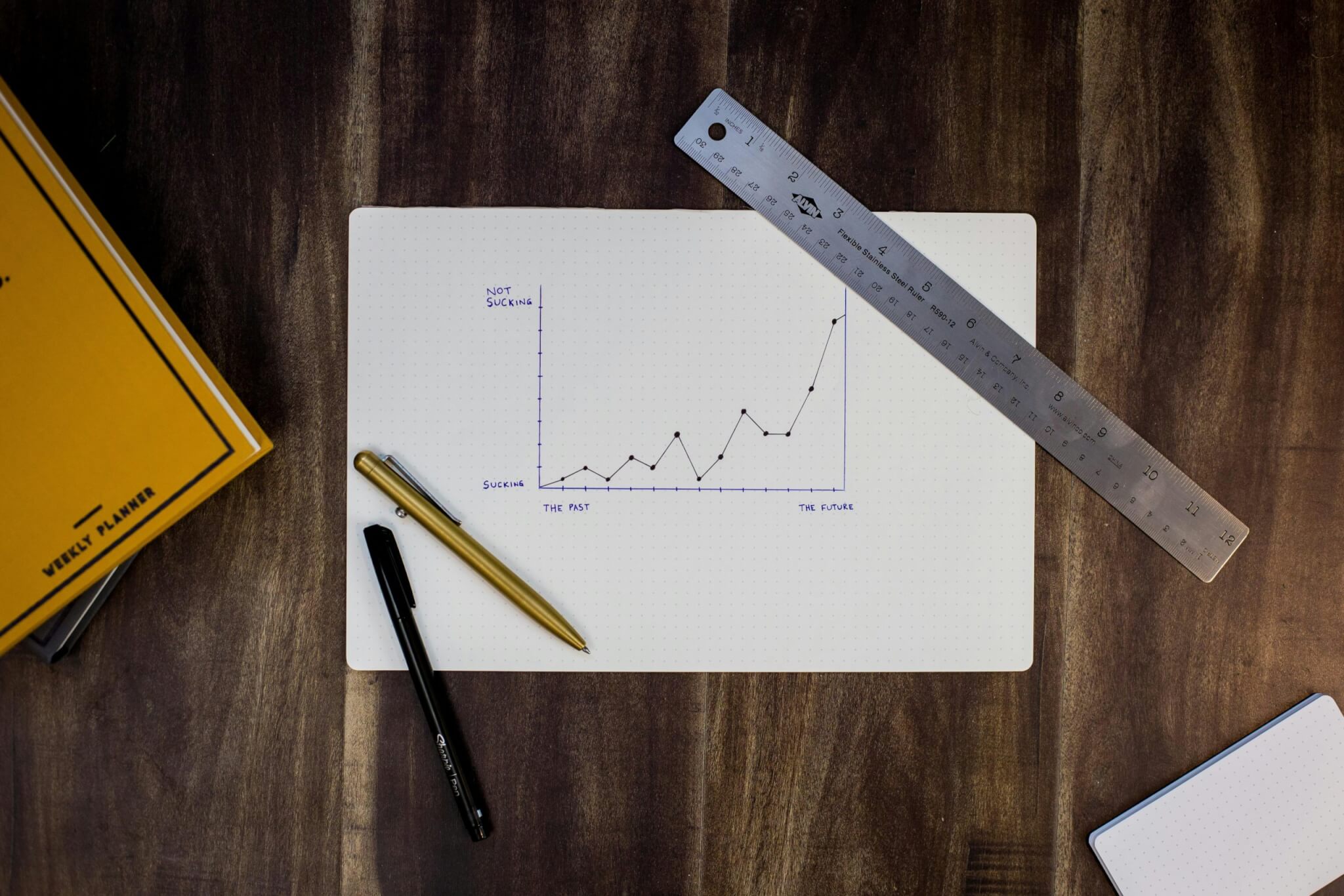

Vertice Services understand that cash flow within a business can sometimes be hit and miss and that flexibility is often useful. We provide additional advanced cash funding for businesses that know money will be coming into their business at a set date in the future, but who need cash now

- Vertice Services has a number of options available to meet the needs of our clients and we understand that no two requirements will be the same. We can therefore, tailor your advanced cash funding to your individual needs and giving you a bespoke service.

What is advanced cash?

An advance of cash is different to a business loan because the lender is effectively buying future sales from the business at a discount. Repayments will come from future revenue and that is why it is sometimes referred to as a revenue loan.

Usually no interest rate is set, however an “advance rate” is used to determine how much will be repaid. In this way the total cost is agreed upfront, making it easy to prepare for. There may be regular payments required at a set amount of total revenue (for example 10%). This makes this type of funding more flexible as payments can be made at a level you can afford based on your revenue.

Why you might need Advanced Cash

Advanced cash can be a lifeline for businesses of all sizes as it can help with a number of scenarios:

- Business set-up in the first few months when turnover is still slow

- The fulfillment of a large order requiring additional materials

- The hiring of extra temporary staff to fulfill a larger than expected order

- Cash to cover the cost of moving to larger premises or buying new equipment

In these scenarios, the business can repay the cash advance as the turnover increases, allowing for the ups and downs of business life.

Contact us to find out how we can help

We are always happy to offer advice on our Advanced Cash options. Just give us a call to discuss your needs with our professional team.

Business advice from experienced accountants

What my client say

Testimonials

Disraeli machado

Empresa

Success Stories

LET`S GROW YOUR BUSINESS

Give us a call with absolutely no obligation and see how we can help your business grow. We already helped more than 3000